Central Bank president: Interest hike not in the cards

The president of the Brazilian Central Bank, Roberto Campos Neto, said in São Paulo on Thursday (Jun. 27) that an increase in interest is not in the institution’s baseline scenario.

During a presser on the quarterly inflation report, Campos Neto said the Central Bank is keeping a watchful eye on the outlook. “As for an increase in interest, that’s not part of our baseline scenario. We understand that the language adopted is compatible with not having given guidance for the future at this time. We are monitoring the scenario and remain vigilant,” he declared.

Campos Neto also commented on the government decree published this week, which instituted the new system that establishes continuous inflation targets, with the National Monetary Council setting the center of the continuous target at three percent, with a tolerance margin of 1.5 percentage points up or down. Any changes to the target must be made three years in advance. This new system will come into force on January 1, 2025.

The move, he wen on to say, should not bring about any changes in the way the Central Bank deals with monetary policy. “It doesn’t mean more or less easing. It’s a process that’s been going on for some time. Internally at the Central Bank, for example, it had been discussed since my arrival. There was an understanding that the fiscal year was not the most efficient way of gauging the results achieved.”

In his view, the minimum 36 months established for a change in the target shows the government’s commitment to transparency and comes in handy, as “it provides stability in forecasting the target and makes financial agents better able to understand the system and have more predictability. And greater predictability means greater capacity for agents to plan.”

Criticism

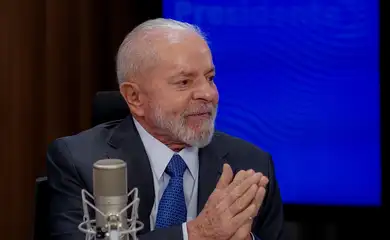

Campos Neto chose not to comment on President Luiz Inácio Lula da Silva’s recent critical remarks about his work at the Central Bank. “It’s not up to me, the president of the Central Bank, to enter into a political debate. We will continue to demonstrate how technical our decisions are.”

He pointed out, however, that some of these pronouncements could have a negative impact on the market and cause difficulties for the Central Bank’s policy. “What has been shown in the recent past—it’s not my opinion, it’s a realization—is that, when we look at market movements in real time with the pronouncements, we see [there has been] a worsening in some macroeconomic variables and some market prices.”